Local News

Fire Losses Emphasize Importance of Insurance

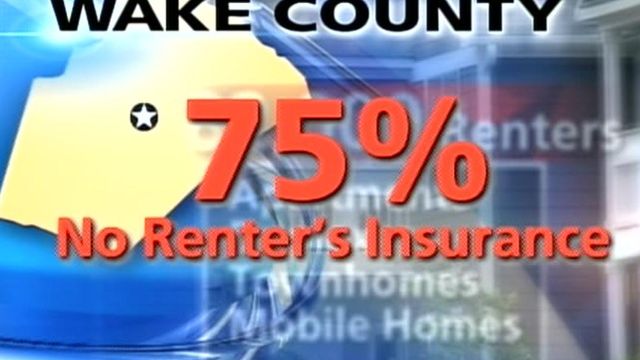

Insurance agents say about 75 percent of the 82,000 people living in Wake County's apartments, duplexes and mobile homes don't purchase the protection for their possessions.

Posted — UpdatedRALEIGH, N.C. — Investigators still don't know what sparked a fire at a Raleigh apartment complex that displaced 29 people Wednesday.

But one fact is known – many of the residents may have lost everything -- they didn’t have renter’s insurance.

Insurance agents say about 75 percent of the 82,000 people living in Wake County's apartments, duplexes and mobile homes don't purchase the protection for their possessions.

You never think it's gonna be you who's affected by the incident, but it can happen to anyone," Concord renter Sarah Doman said. She and her roomate Becky Bascom aren't sure how much they lost in Wednesday's fire, but they know it was not insured.

The manager of the Concord told Allstate agent Jay Adkins that none of the damaged units was insured.

Renters vary in their reasons for not carrying insurance. Some think it’s too expensive, some think they don't need it and some say they've never heard of it.

"People don't want to pay for insurance. ... it's an intangible product. ... it's a promise," Adkins said.

He warned that some renters don't recognize the risks. "The thing about an apartment community is you are responsible for every single person beside you. If they leave a candle on or an iron on, that can cause a fire."

Sarah and Becky are convinced. "I think in the future I will get renters insurance," Sarah said Friday.

They are not alone. Dozens of people who live in the Concord Apartments have picked up insurance applications in the past two days.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.