Moore: Business Principles Should Prevent Mortgage Crisis

Blaming questionable business practices for a record number of foreclosures in recent weeks, especially on sub-prime loans, State Treasurer Richard Moore on Tuesday unveiled a list of principles he said would protect buyers from purchasing homes they can't afford.

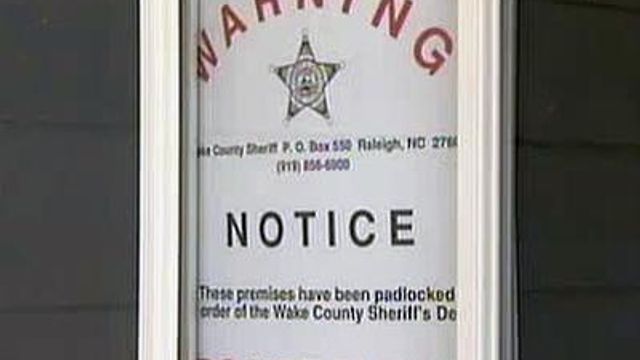

Posted — UpdatedNorth Carolina had 3,380 foreclosures in September, more than double the 1,600 reported during the same month a year ago.

"Too many Americans have been lured to mortgages they could not afford," Moore said, adding that sub-prime lenders focused too much on short-term financial gains rather than the long-term health of the industry.

Sub-prime lenders focus on customers with poor credit histories, and many of the mortgages contained low initial interest rates that eventually adjusted to rates that buyers couldn't afford, forcing them to default on the loans.

Moore's "Mortgage Protection Principles" include the following provisions:

- Match borrowers with the most appropriate, fair and affordable loans for which they qualify.

- Verify and documenting the borrower’s ability to repay the loan for all sub-prime loans.

- Ensure sub-prime loans with an adjustable rate feature are affordable, rather than basing a borrower’s loan qualification on a teaser rate.

- Don't charge prepayment fees or penalties on any sub-prime loans.

- Don't offer employees or brokers incentives to place borrowers into higher-cost loans than those for which they qualify.

- Clearly disclose all expected broker compensation, from lenders or elsewhere, for any loan options presented to the borrower.

- Provide borrowers with a fixed-rate option whenever presenting adjustable-rate products.

- Make the same services available to all similarly situated borrowers and ensure that there is no discrimination on any prohibited basis.

- Conduct criminal background checks to ensure that mortgage brokers are of high moral character.

"We're going to send (lenders and brokers) this list of principles and ask them to voluntarily adopt them," Moore said.

As state treasurer, Moore is responsible for the state's $75 billion pension fund, which holds stocks in some of the nation's largest mortgage lenders.

Darlette McCormick, a Realtor with Coldwell Banker, said she plans to educate her clients about how to avoid foreclosure. She said she has seen too many families lose their dream homes in recent months.

"A lot of homeowners don't know what to do at that point, so they just kind of ignore the problem," McCormick said.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.